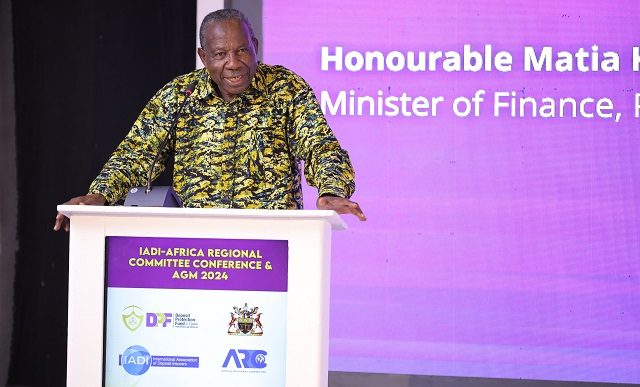

Wakiso, Uganda | Finance Minister, Matia Kasaija says depositors holding accounts with the different should rest assured that their money is insured against risks to the tune of 90%. The deposits are under the Deposit Protection Fund (DPF).

Minister Kasaija was speaking at the Conference and Annual General Meeting of the Africa Regional Committee of the International Association of Deposit Insurers (IADI), which brings together 14 member countries and associate members.

He reported that the Deposit Protection Fund’s assets have grown to beyond 1.4 trillion shillings up from 200 million shillings in 2018.

There are 25 regulated financial institutions including all commercial banks and Tier II Institutions which are, by law, mandated to contribute to the Fund and, in case of a failure, the DPF takes the responsibility of paying depositors up to 10 million of their deposits.

He said the main objective of the Deposit Protection Fund (DPF) is not just to pay the depositors of the affected bank but to give depositors, investors, and the general population the confidence and comfort that whatever happens, their deposits are safe.

Kasaija emphasized the importance of financial stability and robust deposit insurance systems, adding, “Ensuring reliability of the sources of funds and the frugal use of such funds are key tenets necessary for ensuring financial stability.”

The majority of savers in Uganda and other African countries are those with less than 10 million shillings who the Deposit Protection Fund (DPF) targets to protect.

The larger depositors are also protected in various ways, courtesy of the Bank of Uganda.

Apart from paying from the recoverable loans and advances and other assets of the institutions, Michael Atingi-Ego, the Deputy Governor of the Central Bank says there are other approaches that they use.

“We recognize that the protection of depositors extends beyond the insurance threshold,” he says, adding, “For larger deposits, we have mechanisms in place – from purchase and assumption transactions to assisted mergers – to safeguard funds and maintain the integrity of our financial system.”

Atingi-Ego told the delegates that deposit protection funds are increasingly becoming more vital as the financial and economic environment keeps changing.

“As we look to the future, we face new challenges: the rapid evolution of financial technology, the increasing interconnectedness of global markets, and the ever-present threat of economic shocks require us to be ever-vigilant and adaptive.”

The delegates included heads of the deposit protection funds from the member countries as well as Central Bank governors.

The Africa Regional Committee (ARD) is one of the eight that were created to reflect interests and common issues through sharing and exchange of information and ideas on deposit insurance in the different regions.

Julia Clare Olima Oyet, the Chief Executive Officer, of DPF Uganda is the current Chairperson, of ARC.

The committee provides and platform for deposit insurers financial safety net participants and international financial institutions to work together to promote best practices in the areas of deposit protection, bank resolution, and financial stability.

In hailing the decision of the Committee and IADI as a whole to bring the conference and AGM to Uganda, Dr. Oyet said the will use the chance to not only showcase its ability to maintain a strong financial system but also exchange ideas with the agencies from the other countries, at a time that DPF and BOU are paying depositors of the closed Mercantile Credit Bank Ltd.

She said that this year’s theme ‘’Ensuring Financial Stability and Protecting Depositors in a Dynamic Financial Ecosystem’’ is tailored to speak to the developments in the sector.

“The upheavals in the global financial system confirm and emphasize the importance of deposit insurance in protecting the small, vulnerable depositors who we refer to in Uganda as ‘Omuntu wa wansi’,” she said.

As the economy grows and the Fund expands, Oyet said they are reviewing to a threshold of 10 million shillings to decide whether to increase or maintain it, as per the laws that provide for its review every five years, but that they have to be cautious.

“With that 10 million, we are covering 98 percent of depositors fully. But we’re doing research towards reviewing that ceiling because we cannot just increase it. What if we increase it and then we fail to pay,? It means to financial system will lose all the confidence”

Another milestone over the last five years has been the reduction in the time taken to pay depositors affected by a bank’s failure, from years to months and now to four days.

— With files from URN